Probably The key strategy to get an excellent automobile loan will be to be very well-organized. This implies deciding what's very affordable before heading into a dealership initial. Knowing which kind of automobile is wished-for can make it simpler to research and find the best offers to fit your person demands. As soon as a particular make and design is picked out, it is normally useful to own some typical going costs in mind to empower productive negotiations that has a motor vehicle salesman.

Using the values from the example previously mentioned, if the new car was bought inside of a state with no gross sales tax reduction for trade-ins, the revenue tax can be:

If your taxes and charges are bundled in the vehicle loan, make sure to Verify the box 'Include things like taxes and charges in loan' while in the calculator.

For those who now not want one or more of such items you may terminate them and that refund could possibly be placed on the basic principle of your car loan or you might get a refund.

Loan particulars—Lengthier repayment terms can raise the desire level as it is riskier for lenders. Additionally, producing way too low a down payment (that's also noticed as dangerous) can result in the borrower receiving a higher curiosity price.

Inside the U.S., credit history scores and credit reports exist to offer information about Every single borrower so that lenders can assess chance. A credit history score is actually a range between 300 and 850 that represents a borrower's creditworthiness; the upper, the higher.

Because of this, they can possibly reject the lending application or cost increased rates to safeguard them selves through the probability that higher-chance borrowers default. For example, a bank card issuer can increase the fascination rate on an individual's credit card if they start missing a lot of payments.

Just like the marketplace for goods and expert services, the marketplace for credit score is set by source and demand, albeit into a lesser extent. When there exists a surplus of need for cash or credit score, lenders react by increasing desire prices.

The Women of all ages had been most concerned the lender could sue Rebecca and have a lien on her household in Troutville, Virginia. Sabrina stated one of several callers from Navient outlined that possibility to her mother.

In accordance with McBride, owning significantly less equity topics you to definitely a deficiency balance while in the celebration the vehicle is totaled or stolen, and it could require you to pay your insurance company added for gap insurance plan, which is a sort of coverage that addresses the distinction between just what the automobile is really worth and the amount you owe inside the function of an accident if you’re the other way up (monetarily, with any luck , not physically).

By using a lessen regular monthly payment, there's a chance you're in a position to enter into a nicer/more substantial/safer motor vehicle than with a shorter-term loan (on the cost of doubtless paying far more Over-all revenue to take action, having said that).

As may be seen in this quick example, the fascination charge immediately impacts the entire interest paid on any loan. Typically, borrowers want the bottom doable desire costs because it will Price tag much less to borrow; conversely, lenders (or traders) look for significant desire rates for larger sized income. Fascination rates usually are expressed yearly, but costs will also be expressed as regular monthly, daily, or some other period of time.

She been given a observe in early September from Navient which the lender would forgive the non-public university student loan on which she was a co-signer.

Navient experienced decided that Rebecca capable for its incapacity discharge. Rebecca been given the information from the lender not extended soon after CNBC wrote about the Finch family members's circumstance.

Steer clear of Monthly Payments—Spending with dollars relinquishes somebody in the responsibility of constructing month to month payments. This can be a big emotional profit for anyone who would like not to possess a big loan looming around their head for the following number of years. Moreover, the potential of late service fees for late regular monthly payments not exists. Keep away from Desire—No financing involved in the acquisition of a car signifies there'll be no desire billed, that will lead to a decrease In general Price to very own the vehicle. For a quite simple case in point, borrowing $32,000 for 5 years at six% would require a payment of $618.sixty five every month, with a total curiosity click here payment of $5,118.98 more than the life of the loan. Within this scenario, having to pay in income will save $5,118.ninety eight. Upcoming Adaptability—Simply because possession of a car or truck is a hundred% immediately after spending in entire. There are no restrictions on the vehicle, like the correct to sell it after quite a few months, use more affordable coverage coverage, and make particular modifications to the vehicle. Keep away from Overbuying—Having to pay in full with one sum will Restrict auto consumers to what's inside of their instant, calculated spending plan. On the flip side, financed purchases are a lot less concrete and have the probable to lead to car or truck consumers shopping for a lot more than whatever they can pay for long-lasting; it's easy being tempted to add a number of extra bucks to your month-to-month payment to stretch the loan duration out to get a costlier car or truck.

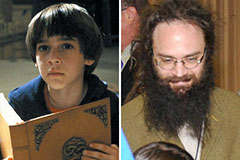

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!